Investments

Transtar Capital Partners offers investors a simplified approach to commercial real estate ownership, focusing on maximizing returns while ensuring diversification of their financial portfolios and wealth creation. As a privately operated and vertically integrated firm, we provide a platform for investors to place their money in high-quality commercial projects, managed by a dedicated team of professionals. At Transtar, we take a hands-on approach, overseeing every aspect of the investment strategy, from underwriting and acquisition to asset management and property management. With our expertise and commitment to simplicity, investors can trust in our comprehensive management.

Investment Strategy

Buy

We are focused on properties that fit our SIM model, with a focus on our Self-storage (S), Industrial (I), and Mobile Home Parks (M).

Transition

When we close escrow, from systems to operations, we layer in our management to quickly complete the transition in a seamless way.

Increase Cash Flow

Once we identify the value-add opportunities, we execute the plan to increase our investors’ cash flow and equity.

Appreciation

As a byproduct of increasing our cash flow and enhancing the overall property, properties will typically appreciate in value.

The (SIM)ple Model

Investing in Self-Storage, Industrial and Mobile Home Communities are a commitment to “simple” real estate asset classes. Our tenants utilize our investments as locations where they can store the items that they cherish, raise a family in a quality home for a reasonable cost, and lease an industrial unit to operate their business. Many of the complexities and costs from office buildings, shopping centers, and apartments do not exist with our SIM ownership focus. Using our SIM model for the asset, we are less dependent on rising employee and maintenance costs to operate. In addition to this, the SIMplicity also drives the way we design our investment structure.

At Transtar Capital Partners, we prioritize simplicity when it comes to our acquisitions. We understand the importance of aligning with our investors, which is why we adhere to a straightforward model. Perhaps the comfort of simplified paperwork is another reason that many of our investors continue to invest with us and have been doing so for close to two decades.

Unlike many ownership structures prevalent in the industry, we have deliberately steered clear of complex waterfall hurdles and inconsistent management fees. We believe in transparency and simplicity, ensuring that our investors have a clear understanding of what to expect and how to calculate their returns. By eliminating complicated structures, we provide a straightforward investment experience that allows our partners to make informed decisions and have confidence in their investment outcomes.

In our acquisitions, we prioritize minimal or no debt, emphasizing financial stability by avoiding excessive borrowing and leveraging. By minimizing debt, we aim to reduce financial risk, establishing a solid foundation for our business activities. This strategy allows us to focus on sustainable growth, reassuring our investors with a sense of security, as they know we prioritize prudent financial management.

To mitigate construction or lease-up risk, the majority of our properties are generating income from day one, ensuring a more predictable return and offering investors a lower risk investment opportunity.

We pride ourselves on offering a comprehensive, one stop shop for all aspects of the investment cycle. While many firms outsource property management, we keep it in-house to ensure effective communication, and provide a seamless experience. By maintaining control over property management and other key elements of ownership, we streamline operations, enhance efficiency, and maximize the value of our investments

Steps to what we do:

Sourcing

Source investment opportunities by leveraging our network of brokers and industry relationships in emerging and existing markets. Since sophisticated brokers know that obtaining financing and capital are the biggest reasons that transactions fall out of escrow, our SIMple acquisition model of all cash transactions set us apart from the majority of potential buyers. This is one reason that over 80% of our closed properties never appeared on the open market and were closed working with a broker on an off market basis. We will often pay the sourcing broker directly and they grow to trust in this relationship. Over 50% of our acquisitions have come from a broker who has sold us other projects.

Underwriting

Identify and underwrite assets that can yield a desirable, long-term return on investment with value-add and expansion opportunities.

Acquiring and Transition

Acquire and transition the property by layering in our management, including in-house operations, marketing, staffing, and revenue management.

Asset Management

Provide tremendous focus and time to improve the property's operations and increase cash flow by creating a strategic plan for capital enhancements, revenue generators, and rent maximization.

Reporting

Actively supplement our investors with reports which will provide financials, progress updates, trends, and future expectations. These are easily accessible via smartphone, tablet or computer through our investor portal.

Investment Portal

Our investments use an all-in-one intelligent platform to handle the commitment of investor capital, communications, and long-term operations.

- Real-time Investment Data and Dashboard Views

- Downloadable Documents

- Upcoming Projects to Invest In

- Easy-to-Read Performance Metrics

- Track Contributions and Distributions

- Submit Contributions with ACH

- IOS and Android Apps

Asset Types we purchase

Self-Storage

Retail Centers

Single-Tenant

Industrial

Multi-Tenant

Industrial

Mobile Home

Parks

Business Parks

Advisory Board

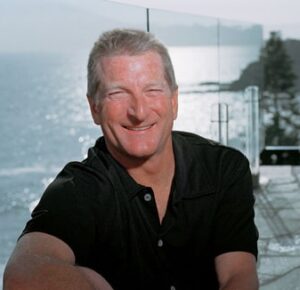

Bob McKnight

Co-Founder of Quiksilver

Bob McKnight is a seasoned entrepreneur and visionary leader who brings....

Jill Gwaltney

Founder of Rauxa

Founder & Chair of Seny, LLC

Jill Gwaltney is an energetic leader and board advisor renowned for her success in building...

Mitch Kelley

Kelley Blue Book

Mitch Kelley brings a wealth of experience and strategic insight to the advisory board of....